CHEMICALS & MATERIALS

Global Curtain Walls Market - Industry Trends and Forecast to 2032

REPORT OVERVIEW

Market Insights

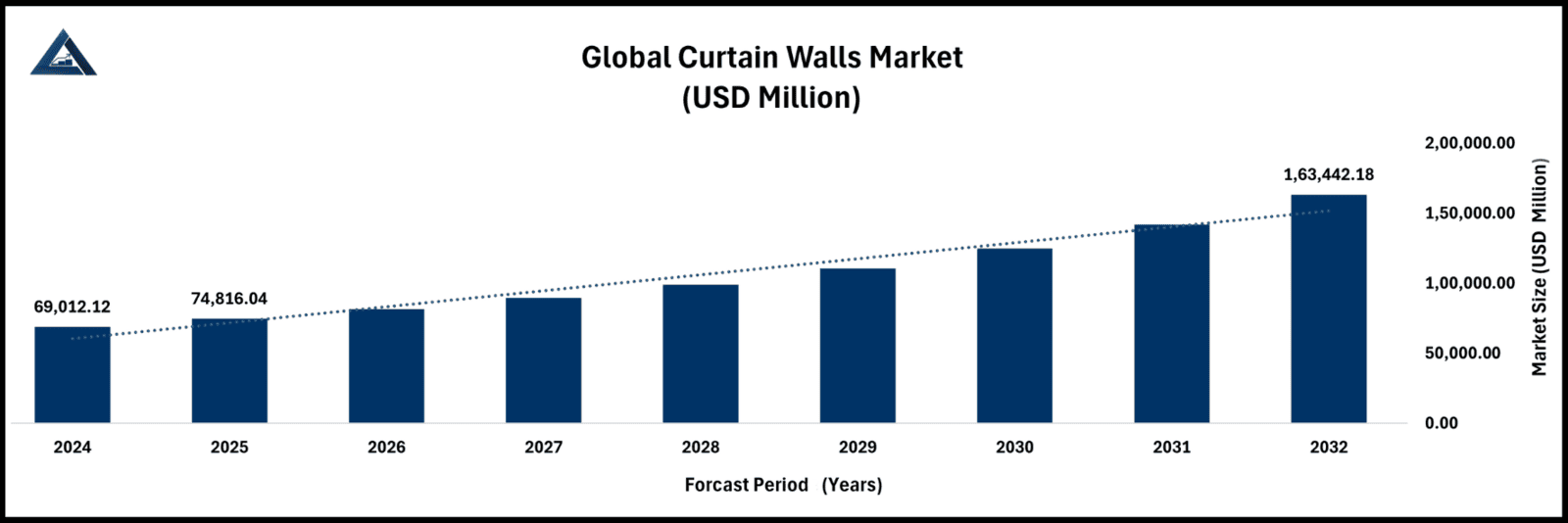

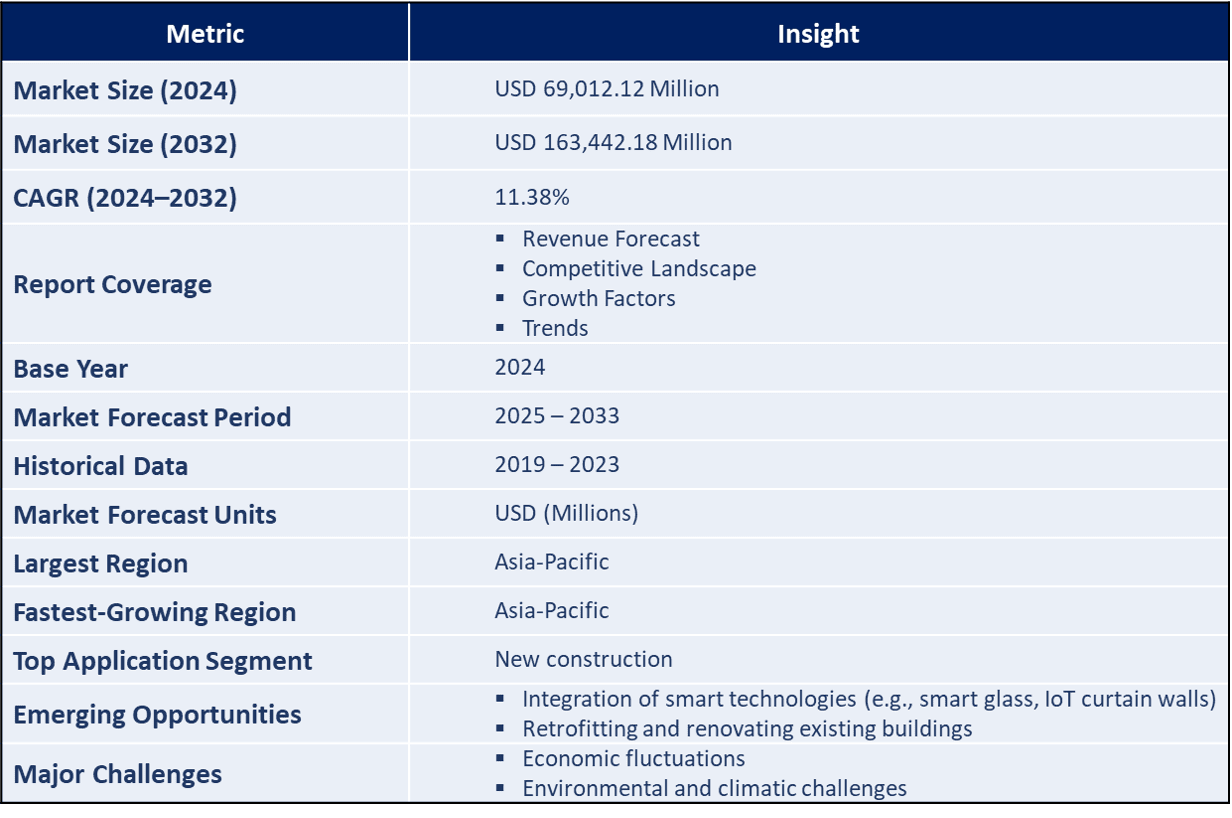

With a projected composite periodic growth rate (CAGR) of 11.38% , the global curtain walls market is anticipated to witness a steady expansion from 2024 to 2032, reaching USD 163,442.18 Million by the end of the forecast period. This developing trend is substantially attributed to the rising objectification of curtain wall systems in modern architectural designs, supporting the broader shift toward green construction by enhancing climate regulation and reducing energy use. Developers and engineers likewise recognize their value in combining façade effectiveness while also delivering architectural flair.

To learn more about this report, Request a free sample copy.

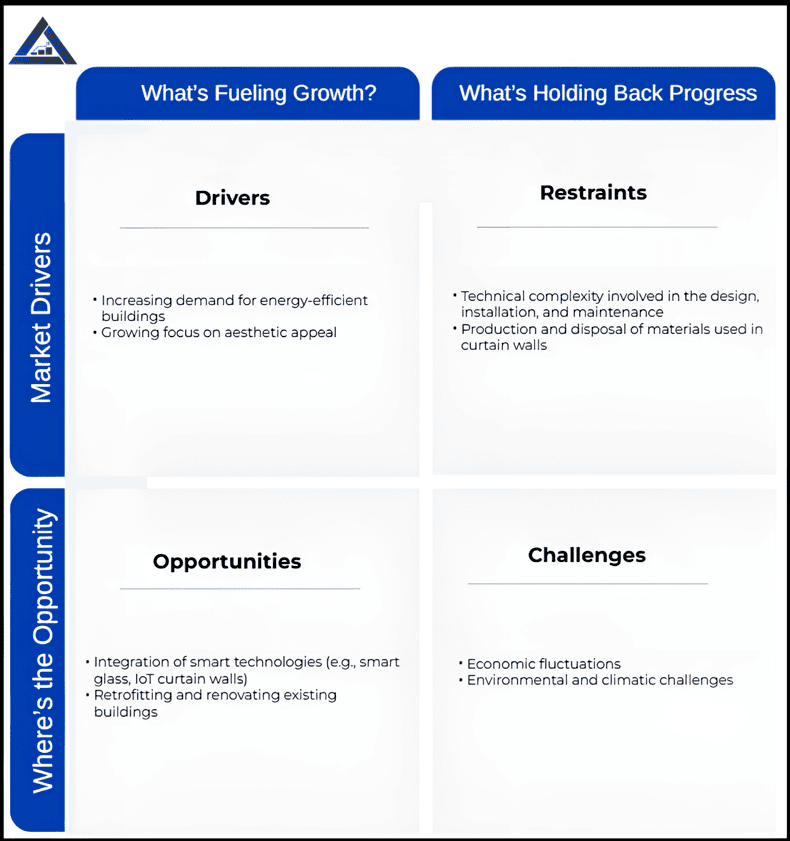

Striking a balance between high energy performance and standout architectural design is fuelling increased implementation of curtain wall systems. As the construction sector continues to elevate its sustainability goals, these systems have become crucial features in defining today's urban architecture, especially in towers and large-scale commercial developments. Curtain walls facilitate abundant natural light, enhance indoor climate operation, and elevate overall energy efficiency, therefore directly aiding in green building certifications and lowering operational costs. Their applicability in the market continues to grow as the global construction sector leans into more intelligent, sustainable design, with curtain walls playing a central role.

While the COVID-19 pandemic shortly slowed construction activity, due to the major setbacks caused by the pandemic, infrastructure recovery has reignited the focus on building strategies that prioritize adaptability, efficiency, and long-term resilience. Curtain walls are gaining recognition as essential components, especially in commercial and institutional spaces where performance and aesthetics are equally critical.

To learn more about this report, Request a free sample copy.

Opportunities: Smart Tech and Building Retrofits Are Changing the Game

The outlook for the global curtain walls market remains largely promising, particularly as technological advancements are converging with rising sustainability objectives. Advanced curtain wall systems, such as glass that adjusts its shade or panels capable of monitoring and regulating energy consumption, are now a reality rather than a concept from science fiction. These innovations are enhancing structures, making them smarter, more energy-efficient, and providing improved comfort for occupants.

Retrofitting existing buildings offers a significant opportunity for advancement. In numerous cities, older structures often have difficulty meeting modern energy standards and current design criteria. The implementation of curtain wall systems in these buildings presents an effective approach to improving both the visual appeal and functional aspects of outdated facades, rejuvenating their look without the need for complete reconstruction. As urban developers and planners in the public sector increasingly prioritize upgrades rather than total reconstructions, the curtain wall market is well-positioned to be instrumental in the anticipated wave of urban transformation.

Challenges: Uncertainty and the Changing Climate

Though prospects for the market remain largely positive, the curtain walls market is encountering significant obstacles. Economic fluctuations—such as varying material prices, unstable interest rates, and evolving global trade relations—can disrupt project timelines. When developers become hesitant, investments in substantial features, like curtain walls, may face delays.

Additionally, the increasing threat of climate issues presents another hurdle. Curtain wall systems now need to be tougher, more adaptive, and better equipped to handle everything from soaring temperatures to powerful storms and high winds, as demand grows for solutions that can endure such extremes. For the global curtain walls market, this necessitates ongoing innovation and a focus on maintaining affordability while enhancing performance.

RESEARCH FOCUS & KEY INSIGHTS DELIVERED

The respective global report analyses market trends, consumer behaviour, and industry dynamics to guide towards entry into new markets with ease. Also, it assists in tailoring market-specific and related products and services to meet the needs, preferences, and expectations of the target audience by delving into their psychology. The report also specializes in comprehensive and extensive competitive analysis, which offers useful insights into competitor strengths, weaknesses, opportunities, and threats. The respective report offers exclusive insights into the potential impact of disruptive developments and technologies that are expected to completely transform corporate operations. The context includes tailor-made research solutions to create a stronger footprint in their particular industries, thereby offering dedicated customized solutions according to the client's needs, which helps in addressing unique business challenges with more simplified and efficient decision-making solutions

SEGMENTATION

- Material

- Glass

- Reflective

- Anti-Reflective

- Low-Iron

- Metal

- Aluminium Facades

- Steel Facades

- Others

- Stone

- Composite

- Product Type

- Three Glazed Type

- Double Glazed Type

- Single Glazed Type

- Installation

- Unitized

- Stick-built

- Semi-unitized

- End-user

- Residential

- Office Buildings

- Retail Spaces and Hotels

- Healthcare Facilities

- Educational Institutions

- Others

- Application

- New Construction

- Retrofit

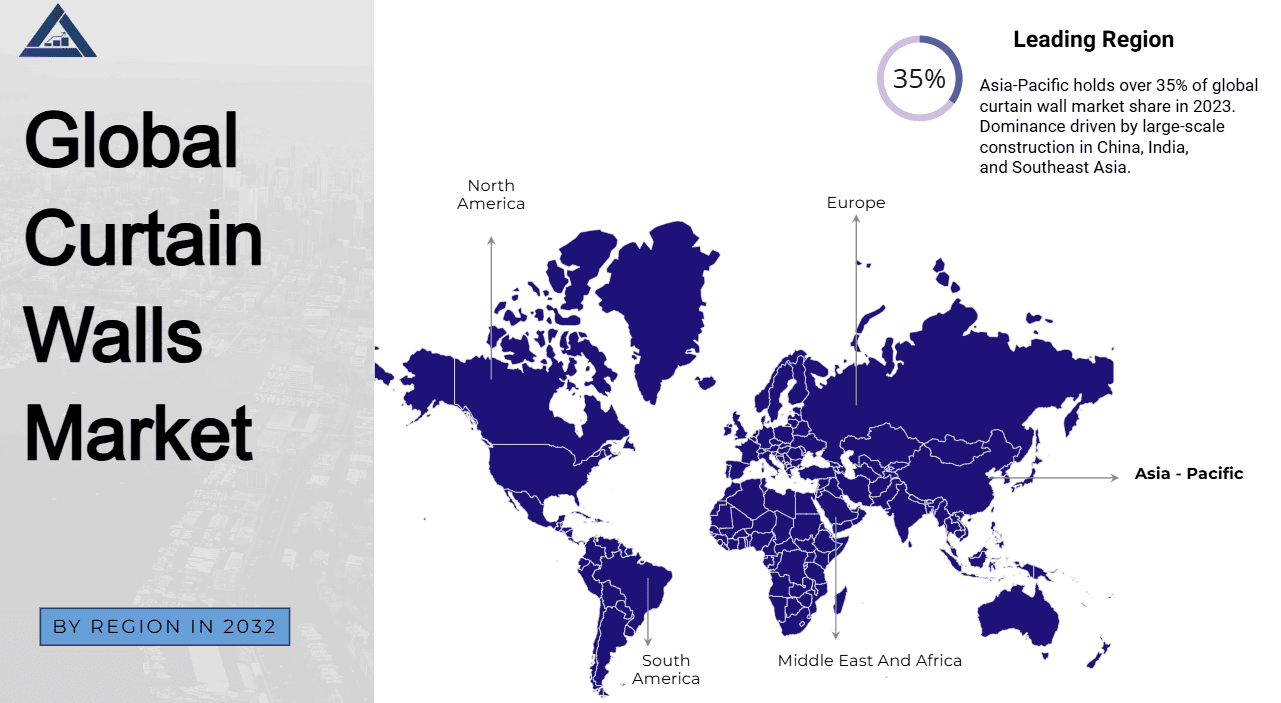

The global market for curtain walls is primarily led by the Asia-Pacific region, holding over 35% of the market, driven by rapid urban development, flourishing construction activities, and extensive infrastructure projects in countries such as China, India, and Southeast Asia. This region's emphasis on high-rise structures, eco-friendly construction standards, and the development of smart cities further enhances demand. Moreover, favourable governmental policies and the growth of commercial real estate help maintain the region's leading position in the market.

To learn more about this report, Request a free sample copy.

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- The Netherlands

- Belgium

- Turkey

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Malaysia

- Australia

- Thailand

- Philippines

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Chile

- Colombia

- Rest of South America

- Middle East and Africa

- Kingdom of Saudi Arabia

- South Africa

- U.A.E.

- Egypt

- Rest of Middle East and Africa

KEY MARKET PLAYERS

- AGC Inc.

- Reynaers Aluminium

- Pilkington

- Vitro

- Apogee Enterprises Inc.

- WICONA

- Central Glass

- Alumil

- Arconic

- Schüco International

CURTAIN WALL MARKET REPORT SCOPE

Table OF CONTENTS

- SECTION 1 - INTRODUCTION

- 1.1 Taxonomy

- 1.2 Market Overview

- 1.3 Currency and Limitations

- 1.3.1 Currency

- 1.3.2 Limitations

- 1.4 Key Competitors

- SECTION 2 - RESEARCH METHODOLOGY

- 2.1 Research Approach

- 2.2 Data Collection and Validation

- 2.2.1 Secondary Research

- 2.2.2 Primary Research

- 2.3 Market Assessment

- 2.3.1 Market Size Estimation

- 2.3.2 Bottom-up Approach

- 2.3.3 Top-down Approach

- 2.3.4 Growth Forecast

- 2.4 Market Study Assumptions

- 2.5 Data Sources

- SECTION 3 - EXECUTIVE SUMMARY

- 3.1 Global Curtain Walls Market, by Material

- 3.2 Global Curtain Walls Market, by Product Type

- 3.3 Global Curtain Walls Market, by Installation

- 3.4 Global Curtain Walls Market, by End-user

- 3.5 Global Curtain Walls Market, by Application

- 3.6 Global Curtain Walls Market, by Geography

- 3.7 Market Position Grid

- SECTION 4 - PREMIUM INSIGHTS

- 4.1 Regulatory Framework

- 4.1.1 Standards

- 4.1.2 Regulatory Landscape

- 4.2 Value Chain Analysis

- 4.3 Supply Chain Analysis

- 4.4 COVID-19 Impact

- 4.5 Russia-Ukraine War Impact

- 4.6 PORTER's Five Force Analysis

- 4.7 PESTLE Analysis

- 4.8 SWOT Analysis

- 4.9 Go to Market Strategy

- 4.10 Opportunity Orbit

- 4.11 Multivariate Modelling

- 4.12 Pricing Analysis

- SECTION 5 - MARKET DYNAMICS

- 5.1 Trends

- 5.1.1 Trend towards using sustainable materials

- 5.1.2 Adoption of prefabrication and modular construction techniques

- 5.1.3 Trend 3

- 5.2 Drivers

- 5.2.1 Increasing demand for energy-efficient buildings

- 5.2.2 Growing focus on aesthetic appeal

- 5.2.3 Driver 3

- 5.2.4 Driver 4

- 5.3 Restraints

- 5.3.1 Technical complexity involved in the design, installation, and maintenance

- 5.3.2 Production and disposal of materials used in curtain walls

- 5.3.3 Restraint 3

- 5.4 Opportunities

- 5.4.1 Integration of smart technologies, such as smart glass and IoT-enabled curtain walls

- 5.4.2 Growing trend of retrofitting and renovating existing buildings

- 5.4.3 Opportunity 3

- 5.4.4 Opportunity 4

- 5.5 Challenges

- 5.5.1 Economic fluctuations

- 5.5.2 Environmental and climatic challenges

- 5.5.3 Challenge 3

- SECTION 6 - GLOBAL CURTAIN WALLS MARKET, BY MATERIAL

- 6.1 Material Summary

- 6.2 Market Attractive Index

- 6.3 Global Curtain Walls Market, by Material (2019-2032)

- SECTION 7 - GLOBAL CURTAIN WALLS MARKET, BY PRODUCT TYPE

- 7.1 Product Type Summary

- 7.2 Market Attractive Index

- 7.3 Global Curtain Walls Market, by Product Type (2019-2032)

- SECTION 8 - GLOBAL CURTAIN WALLS MARKET, BY INSTALLATION

- 8.1 Installation Summary

- 8.2 Market Attractive Index

- 8.3 Global Curtain Walls Market, by Installation (2019-2032)

- SECTION 9 - GLOBAL CURTAIN WALLS MARKET, BY END-USER

- 9.1 End-user Summary

- 9.2 Market Attractive Index

- 9.3 Global Curtain Walls Market, by End-user (2019-2032)

- SECTION 10 - GLOBAL CURTAIN WALLS MARKET, BY APPLICATION

- 10.1 Application Summary

- 10.2 Market Attractive Index

- 10.3 Global Curtain Walls Market, by Application (2019-2032)

- SECTION 11 - GLOBAL CURTAIN WALLS MARKET, BY GEOGRAPHY

- 11.1 Regional Summary

- 11.2 Market Attractive Index

- 11.3 Global Curtain Walls Market, by Geography (2019-2032)

- SECTION 12 - NORTH AMERICA CURTAIN WALLS MARKET

- 12.1 North America Summary

- 12.2 Market Attractive Index

- 12.3 North America Curtain Walls Market, by Material (2019-2032)

- 12.4 North America Curtain Walls Market, by Product Type (2019-2032)

- 12.5 North America Curtain Walls Market, by Installation (2019-2032)

- 12.6 North America Curtain Walls Market, by End-user (2019-2032)

- 12.7 North America Curtain Walls Market, by Application (2019-2032)

- 12.8 North America Curtain Walls Market, by Country (2019-2032)

- 12.8.1 U.S.

- 12.8.2 Canada

- 12.8.3 Mexico

- 12.8.4 Rest of North America

- SECTION 13 - EUROPE CURTAIN WALLS MARKET

- 13.1 Europe Summary

- 13.2 Market Attractive Index

- 13.3 Europe Curtain Walls Market, by Material (2019-2032)

- 13.4 Europe Curtain Walls Market, by Product Type (2019-2032)

- 13.5 Europe Curtain Walls Market, by Installation (2019-2032)

- 13.6 Europe Curtain Walls Market, by End-user (2019-2032)

- 13.7 Europe Curtain Walls Market, by Application (2019-2032)

- 13.8 Europe Curtain Walls Market, by Country (2019-2032)

- 13.8.1 Germany

- 13.8.2 U.K.

- 13.8.3 France

- 13.8.4 Italy

- 13.8.5 Spain

- 13.8.6 Russia

- 13.8.7 The Netherlands

- 13.8.8 Belgium

- 13.8.9 Turkey

- 13.8.10 Rest of Europe

- SECTION 14 - ASIA-PACIFIC CURTAIN WALLS MARKET

- 14.1 Asia-Pacific Summary

- 14.2 Market Attractive Index

- 14.3 Asia-Pacific Curtain Walls Market, by Material (2019-2032)

- 14.4 Asia-Pacific Curtain Walls Market, by Product Type (2019-2032)

- 14.5 Asia-Pacific Curtain Walls Market, by Installation (2019-2032)

- 14.6 Asia-Pacific Curtain Walls Market, by End-user (2019-2032)

- 14.7 Asia-Pacific Curtain Walls Market, by Application (2019-2032)

- 14.8 Asia-Pacific Curtain Walls Market, by Country (2019-2032)

- 14.8.1 China

- 14.8.2 India

- 14.8.3 Japan

- 14.8.4 South Korea

- 14.8.5 Singapore

- 14.8.6 Malaysia

- 14.8.7 Australia

- 14.8.8 Thailand

- 14.8.9 Philippines

- 14.8.10 Rest of Asia-Pacific

- SECTION 15 - SOUTH AMERICA CURTAIN WALLS MARKET

- 15.1 South America Summary

- 15.2 Market Attractive Index

- 15.3 South America Curtain Walls Market, by Material (2019-2032)

- 15.4 South America Curtain Walls Market, by Product Type (2019-2032)

- 15.5 South America Curtain Walls Market, by Installation (2019-2032)

- 15.6 South America Curtain Walls Market, by End-user (2019-2032)

- 15.7 South America Curtain Walls Market, by Application (2019-2032)

- 15.8 South America Curtain Walls Market, by Country (2019-2032)

- 15.8.1 Brazil

- 15.8.2 Argentina

- 15.8.3 Chile

- 15.8.4 Colombia

- 15.8.5 Rest of South America

- SECTION 16 - MIDDLE EAST AND AFRICA CURTAIN WALLS MARKET

- 16.1 Middle East and Africa Summary

- 16.2 Market Attractive Index

- 16.3 Middle East and Africa Curtain Walls Market, by Material (2019-2032)

- 16.4 Middle East and Africa Curtain Walls Market, by Product Type (2019-2032)

- 16.5 Middle East and Africa Curtain Walls Market, by Installation (2019-2032)

- 16.6 Middle East and Africa Curtain Walls Market, by End-user (2019-2032)

- 16.7 Middle East and Africa Curtain Walls Market, by Application (2019-2032)

- 16.8 Middle East and Africa Curtain Walls Market, by Country (2019-2032)

- 16.8.1 Kingdom of Saudi Arabia

- 16.8.2 South Africa

- 16.8.3 U.A.E.

- 16.8.4 Egypt

- 16.8.5 Rest of Middle East and Africa

- SECTION 17 - COMPANY SHARE ANALYSIS

- 17.1 Global Curtain Walls Market, Company Share Analysis

- 17.2 North America Curtain Walls Market, Company Share Analysis

- 17.3 Europe Curtain Walls Market, Company Share Analysis

- 17.4 Asia-Pacific Curtain Walls Market, Company Share Analysis

- SECTION 18 - COMPANY PROFILES

- 18.1 AGC Inc.

- 18.1.1 Company Snapshot

- 18.1.2 Financial Overview

- 18.1.3 Product Portfolio

- 18.1.4 Recent Developments

- 18.2 Reynaers Aluminium

- 18.2.1 Company Snapshot

- 18.2.2 Financial Overview

- 18.2.3 Product Portfolio

- 18.2.4 Recent Developments

- 18.3 Pilkington

- 18.3.1 Company Snapshot

- 18.3.2 Financial Overview

- 18.3.3 Product Portfolio

- 18.3.4 Recent Developments

- 18.4 Vitro

- 18.4.1 Company Snapshot

- 18.4.2 Financial Overview

- 18.4.3 Product Portfolio

- 18.4.4 Recent Developments

- 18.5 Apogee Enterprises Inc.

- 18.5.1 Company Snapshot

- 18.5.2 Financial Overview

- 18.5.3 Product Portfolio

- 18.5.4 Recent Developments

- 18.6 Guardian Industries

- 18.6.1 Company Snapshot

- 18.6.2 Financial Overview

- 18.6.3 Product Portfolio

- 18.6.4 Recent Developments

- 18.7 Central Glass

- 18.7.1 Company Snapshot

- 18.7.2 Financial Overview

- 18.7.3 Product Portfolio

- 18.7.4 Recent Developments

- 18.8 Alumil

- 18.8.1 Company Snapshot

- 18.8.2 Financial Overview

- 18.8.3 Product Portfolio

- 18.8.4 Recent Developments

- 18.9 Arconic

- 18.9.1 Company Snapshot

- 18.9.2 Financial Overview

- 18.9.3 Product Portfolio

- 18.9.4 Recent Developments

- 18.10 Schüco International

- 18.10.1 Company Snapshot

- 18.10.2 Financial Overview

- 18.10.3 Product Portfolio

- 18.10.4 Recent Developments

- SECTION 19 - RELATED REPORTS

- SECTION 20 - DISCLAIMER

RESEARCH METHODOLOGY

RESEARCH AND DATA COLLECTION

- Research articles published on Technium

- Science and MDPI

- Research publications by government approved associations and societies

DATA PRE-PROCESSING

The term "data pre-processing" refers to the collection of procedures and methods used to clean, modify, and make ready for analysis the raw data gathered during research and data collection. The completion of this phase is necessary to guarantee that the data are reliable, consistent, and appropriate for statistical analysis and other data-driven tasks. The data pre-processing ensures that the information gathered from research and data collection is comparable and expressed in standard units, by the integration of missing data pointers and algorithmic approaches.

MODELING AND FORECASTING

QUALITY ASSURANCE AND OUTPUT

Quality assurance and output involves the process of validation, adjustments, further publications of key market indicators. Extensive plausibility and consistency tests are performed on derived time series to ensure the high degree of quality of our market analysis. This quality assurance procedure also includes rigorous inspection, validation, and editing by an experienced management team to assure the dependability of the published data.